What Happened to ItsDeductible? (2026 Update + What To Do Now)

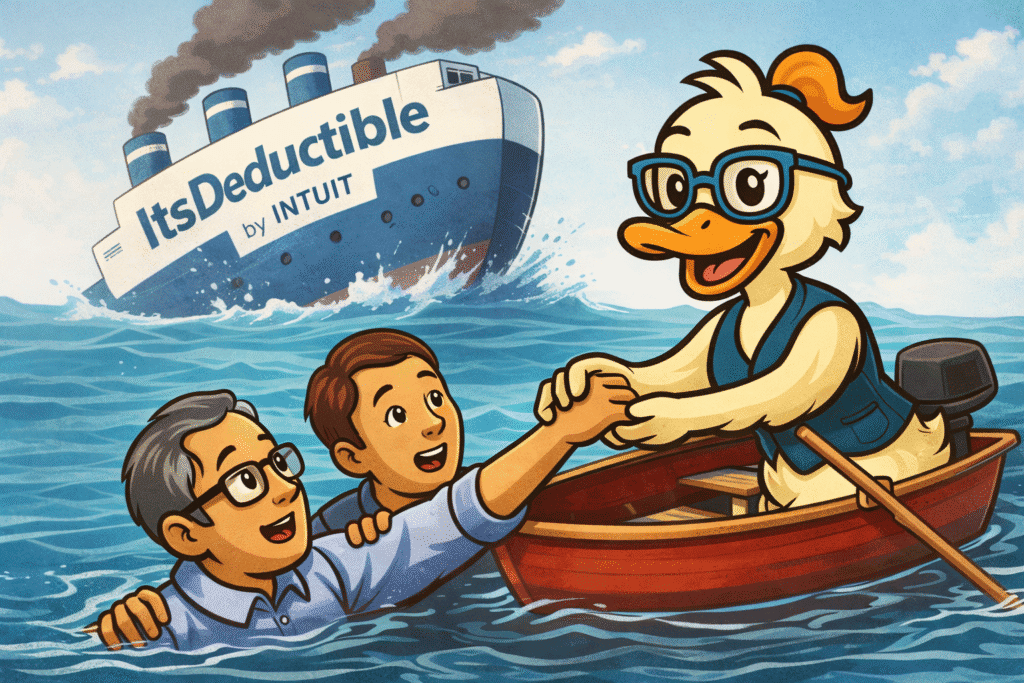

ItsDeductible was a charitable donation tracking software created by Intuit and discontinued in 2025. If you used TurboTax for years, you may remember using it. Many people used it to track clothing donations, household items, and Goodwill drop-offs. Then suddenly — it was gone. What happened to ItsDeductible?

You are not imagining it.

You didn’t delete your account.

And you didn’t do anything wrong.

Intuit, the company that makes TurboTax, discontinued ItsDeductible. This guide explains what happened to ItsDeductible, what that means for you, your taxes, and your records — and what you should do now.

What ItsDeductible Was

ItsDeductible was a donation-tracking program created by Intuit. It helped taxpayers keep records of charitable donations throughout the year.

You could record things like:

- clothing donations

- furniture donations

- household goods

- cash gifts to charities

- mileage driven for charity work

The tool estimated the fair market value of donated items and automatically transferred totals into TurboTax during tax season.

That is, until ItsDeductible was discontinued.

History of ItsDeductible

ItsDeductible was not a new tool. It had been around for many years and became part of the normal routine for people who used TurboTax.

The program was created by Intuit to solve a very specific problem: people often donated items to charities during the year but forgot to keep good records. Clothing bags, kitchen items, books, and small furniture were easy to give away — but hard to remember months later at tax time.

ItsDeductible changed that habit.

Instead of guessing at the end of the year, taxpayers could enter donations as they happened. After a Goodwill or church drop-off, they could log in and record the items immediately. The software estimated a typical thrift-store value and stored the donation in one place.

The most important feature was the TurboTax connection.

When tax season arrived, users could sign in to TurboTax and import their donations automatically. The totals appeared inside their tax return without re-entering everything. For many families, this became a yearly routine:

donate items → record them in ItsDeductible → import into TurboTax → file taxes

Because of that workflow, many long-time TurboTax customers relied on ItsDeductible every year. Some users had donation histories going back many filing seasons, which is why the shutdown was confusing and worrying when access suddenly disappeared.

When Intuit Discontinued ItsDeductible

Intuit shut down ItsDeductible on October 21, 2025 (during the 2024 tax cycle) as part of a product realignment. The mobile app and standalone website access were removed, and users could no longer log in to view or maintain donation records.

After the shutdown:

- accounts were no longer accessible

- historical records were not available through the old login

- the standalone service stopped functioning

This is why many people first wondered “what happened to ItsDeductible” when they opened TurboTax and could no longer import donations.

Why It Was Shut Down

Intuit did not publicly provide a detailed technical explanation, but product changes like this usually happen for predictable reasons:

- maintaining older systems becomes expensive

- fewer users rely on itemized deductions after tax law changes

- the company focuses on core tax filing features instead of companion tools

In short, the donation tracker was no longer central to TurboTax’s business model. Publicly, Intuit provided no plausible explanations about the shutdown.

Unfortunately, many long-time users still depended on it.

What Happened to Your Donation Records

This is the question people worry about most.

Your past donations are available as a download, but the format is aimed at Excel power users and the data itself is not consistent with past ItsDeductible exports. You can read more about it on this Intuit forum post here.

If you did not export or print ItsDeductible records before the shutdown, you cannot retrieve them from the original ItsDeductible website anymore. Only the “data download” option remains (and it’s not ideal).

That does not automatically mean you lose your deduction.

The IRS does not require you to use ItsDeductible specifically. What the IRS requires is documentation.

Do TurboTax Imports Still Work?

No.

Because of what happened to ItsDeductible, the automatic import from ItsDeductible into TurboTax is no longer available because the service behind it was retired.

You can still enter donations manually in TurboTax — but you must provide your own records.

IRS Rules for Charitable Donation Records (Important)

The IRS requires different documentation depending on donation size:

For any donation

You must have:

- the charity name

- the donation date

- a reasonable description of items donated

Donations under $250

You need a receipt or written record showing the charity received the items.

Donations $250 or more

You must have a written acknowledgment letter from the charity.

Non-cash donations over $500

You must complete IRS Form 8283 when filing your taxes.

ItsDeductible helped organize this — but it was never the official proof. Your receipts were always the primary documentation.

What You Should Do Before Filing Taxes

If you previously relied on ItsDeductible:

- Gather charity receipts (Goodwill, Salvation Army, church, etc.)

- Find old emails confirming donations

- Check bank or credit card statements for cash gifts

- Look for photos taken during donations

- Review past tax returns (they often list totals you can rebuild from)

Do not ignore this step. The IRS cares about documentation — not the software you used.

How to Reconstruct Past Donation Records

You can safely rebuild records using a simple process:

Step 1 — List the charities you donated to

Goodwill, Habitat for Humanity, churches, schools, shelters.

Step 2 — Recreate approximate dates

Use:

- calendar memories (spring cleaning, moving, holidays)

- email searches

- photos on your phone

Step 3 — Recreate items donated

Example:

“4 bags of clothing, kitchenware box, small bookshelf”

Step 4 — Assign fair market value

Use typical thrift-store values (not purchase price).

The IRS standard is “what a willing buyer would pay at a thrift store,” not original retail cost.

Keep the reconstruction with your tax records.

Options Available Now

Since ItsDeductible is no longer available, taxpayers now have three choices:

- Track donations manually on paper or spreadsheets

- Enter everything directly into TurboTax each year

- Use a dedicated donation tracking tool designed for tax records

The important thing is consistency.

The IRS prefers a clear, year-long record over last-minute estimates.

(Brief note: Some taxpayers choose modern tools created specifically to replace the old ItsDeductible workflow and maintain records year-round, but the key requirement is accurate documentation and receipts.) You can read about modern donation-tracking options here.

Final Thoughts on What Happened to ItsDeductible

ItsDeductible was useful because it created a simple habit: record donations as they happened.

The software is gone, but the responsibility did not disappear.

You can still claim charitable deductions safely. You just need organized records.

If you rebuild your documentation now — before filing — you will be in the same position you were when the program existed.

The important thing is not the tool.

The important thing is having a record you can explain if the IRS ever asks.

Not tax advice. This article is general educational information. For advice about your situation, talk with a qualified tax professional. IRS rules can change, and your facts matter.