Overview

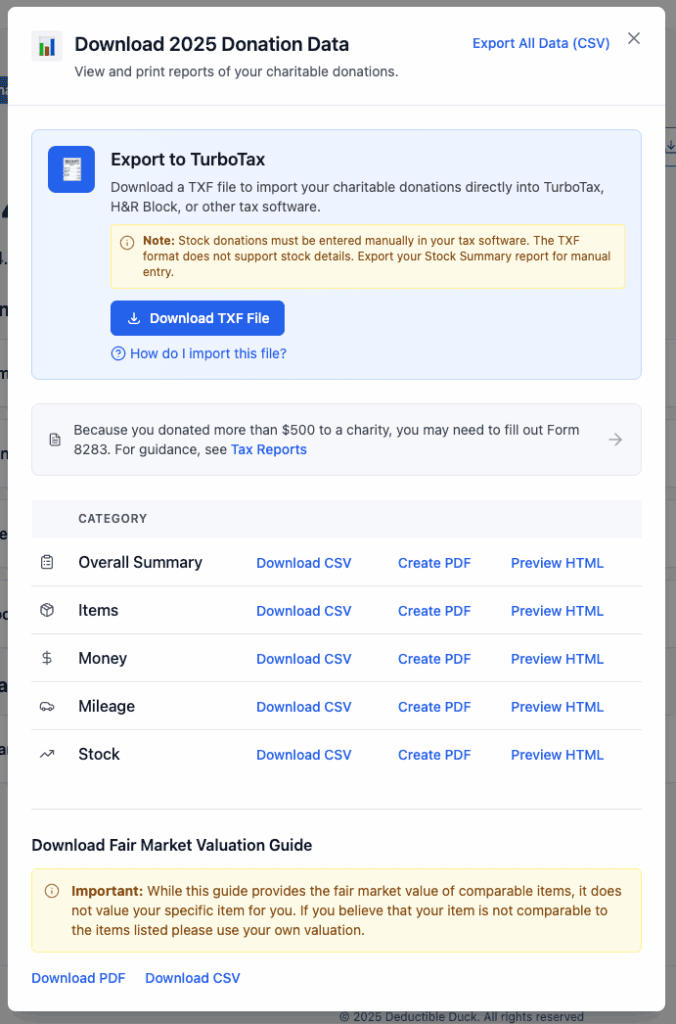

The Download My Data dialog allows users to view and print reports of their charitable donations. It provides multiple export and preview options across different donation categories and formats.

Export to TurboTax Section

Description: Download a TXF file to import your charitable donations directly into TurboTax, H&R Block, or other tax software.

Click the “Download TXF File” button to get a file to import into your tax software (e.g. TurboTax). This is how your get your donation information OUT of Deductible Duck and INTO your tax software.

Important Note: Because the TXF format is very limited and old, your Stock donations must be entered manually in your tax software. The TXF format does not support stock details. Export your Stock Summary report for manual entry.

Help Link: “How do I import this file?” Click this link to find out detailed instructions on how to import your TXF file into other tax programs, like TurboTax.

What is Form 8283?

Form 8283 (Noncash Charitable Contributions) is an IRS form you must attach to your tax return when you donate property (not cash) worth more than $500 to charity.

Filing threshold: Form 8283 is required when ANY single noncash donation exceeds $500. The threshold applies per item, not the aggregate total.

Section A ($500 – $5,000 per item): Most donations fall here. No appraisal required.

Section B (Over $5,000 per item): Requires a qualified appraisal and additional signatures.

What Deductible Duck Provides

Deductible Duck collects and tracks the following information required for Form 8283:

- ✓ Property description: Detailed item descriptions from our 1,700+ item database

- ✓ Donation date: When you made the donation

- ✓ Fair Market Value (FMV): Based on thrift shop values and comparable sales

- ✓ FMV determination method: Thrift shop values from IRS Publication 561

- ✓ Charity information: Name, address, and EIN

Why Can’t Deductible Duck Fill This Out For Me?

Form 8283 requires specific information about each donated item that most people simply don’t have: the acquisition date, how you acquired the item, and the original cost or basis.

Why this is difficult for item donations:

- Most used household items were purchased months or years ago

- People rarely keep receipts for clothing, books, furniture, or household goods

- Many items may have been gifts, inherited, or acquired in ways that are difficult to document

- Tracking hundreds of individual items’ acquisition dates and costs is unrealistic for most donors

The IRS understands this reality. IRS Publication 561 acknowledges that taxpayers may not have complete records for used household items. You can use reasonable estimates for acquisition information when completing Form 8283.

What Deductible Duck does for you: We focus on the hardest part of Form 8283 – determining fair market value. Our database of 1,700+ items with pricing based on thrift shop values and IRS Publication 561 guidance provides you with defensible FMV estimates. This is the most difficult and important aspect of noncash charitable deductions.

What You Need to Track Separately

For item donations over $500, Form 8283 also requires:

- Date acquired: The month and year you originally obtained the item

- How acquired: Whether you purchased it, received it as a gift, inherited it, or obtained it through an exchange

- Original cost or basis: What you paid for the item (or its fair market value if it was a gift)

Important note: For most used household items (clothing, furniture, books), you may not have acquisition dates or original receipts. This is normal and acceptable. The IRS understands that people don’t keep receipts for items purchased years ago. See IRS Publication 561 for guidance on estimating these values.

How to Complete Form 8283

Follow these steps when filing your taxes:

The IRS may request documentation if your return is audited

Export your donation data:

Go to the “Download Data” section from your dashboard

Download the Items Summary report (CSV or PDF)

This report contains all the information Deductible Duck has tracked for you

Navigate to charitable contributions in your tax software:

TurboTax: Deductions & Credits → Charitable Donations → I’ll enter my donations → Clothes and Household Items

H&R Block: Deductions → Charitable Contributions → Household Items and Clothing

TaxAct: Deductions → Itemized Deductions → Charitable Cash & Noncash Contributions

Enter your donation information:

Copy information from your Deductible Duck export

Enter item descriptions, quantities, fair market values

For acquisition date and original cost, use your best estimate or actual records if available

Your tax software will automatically generate Form 8283

Review and file:

Your tax software will include Form 8283 with your tax return

Keep your Deductible Duck reports and charity receipts for your records

Category Export Options

A table with the following donation categories, each offering three export/preview formats to show your donations for the ENTIRE TAX YEAR:

Categories (provides the report for the entire tax year):

- Overall Summary (provides ALL types of donations in the report)

- Items (item-only donation reports)

- Money (money-only donation reports)

- Mileage (mileage-only donation reports)

- Stock (stock-only donation reports)

Available Formats for Each Category:

- Download CSV – Export data as CSV file, great for your personal records or to do your own reporting in Excel

- Create PDF – Generate PDF report, perfect for saving copies in your records, printing reports or sending to your CPA/tax professional

- Preview HTML – View HTML preview in browser to see what’s in the PDF, or you can print it directly in the browser. Quick view for easy access (faster than the PDF)

Each category row displays all three options as clickable buttons.

Download Fair Market Valuation Guide

Section Header: “Download Fair Market Valuation Guide”

Important Notice: While this guide provides the fair market value of comparable items, it does not value your specific item for you. If you believe that your item is not comparable to the items listed please use your own valuation.

Download Options:

- “Download PDF” button, if you want a copy of the Fair Market Value guide as a PDF document for reference

- “Download CSV” button, if you want a copy of the Fair Market Value guide as a CSV document for reference

Additional Options

Export All Data (CSV) button – Located in top-right corner for bulk data export. This generates a ZIP file of ALL CSVs for your records. You will have empty (placeholder) CSVs for any donations you didn’t make (e.g. If you didn’t make a stock donation in a tax year, you’ll have an empty CSV for stock donations)